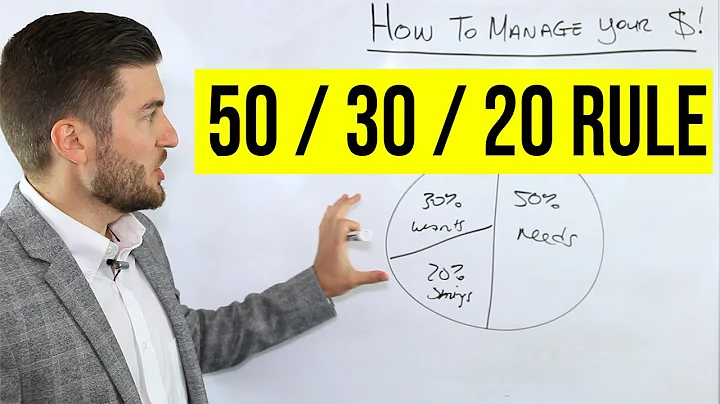

What is the 50 30 20 rule in your financial plan?

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals.

Applying the 50/30/20 rule would give them a monthly budget of: 50% for mandatory expenses = $2,500. 20% to savings and debt repayment = $1,000. 30% for wants and discretionary spending = $1,500.

The rule is a template that is intended to help individuals manage their money and save for emergencies and retirement. The purpose of the 50/30/20 rule is to balance paying for necessities while being mindful of long-term savings and retirement.

One of the most common types of percentage-based budgets is the 50/30/20 rule. The idea is to divide your income into three categories, spending 50% on needs, 30% on wants, and 20% on savings. Learn more about the 50/30/20 budget rule and if it's right for you.

Cardone says that from your gross income, 40% should be set aside for taxes, 40% should be saved, and you should live off of the remaining 20%.

Some Experts Say the 50/30/20 Is Not a Good Rule at All. “This budget is restrictive and does not take into consideration your values, lifestyle and money goals. For example, 50% for needs is not enough for those in high-cost-of-living areas.

Drawbacks of the 50/30/20 Rule

Another issue is the feasibility of the system. Keeping necessities to 50% or less of income can be very difficult if you live in an expensive area and already spend a big portion of your earnings on rent or a mortgage.

For many people, the 50/30/20 rule works extremely well—it provides significant room in your budget for discretionary spending while setting aside income to pay down debt and save. But the exact breakdown between “needs,” “wants” and savings may not be ideal for everyone.

Important reminder: The 50/30/20 budget rule only considers your take-home pay for the month, so anything automatically deducted from your paycheck — like your work health insurance premium or 401k retirement contribution — doesn't count in the equation.

If you're looking for a ballpark figure, Taylor Kovar, certified financial planner and CEO of Kovar Wealth Management says, “By age 30, a good rule of thumb is to aim to have saved the equivalent of your annual salary. Let's say you're earning $50,000 a year. By 30, it would be beneficial to have $50,000 saved.

What percent should you pay yourself first?

Setting aside 5% to 10% of your paycheck is a good goal, but if money is tight, start small. It's important to be consistent and develop a habit. Consider using the 50-30-20 rule: 50% of your income goes toward necessities, 30% to discretionary spending and 20% to savings or paying down debt.

(What I call the Four Walls go first—food, utilities, shelter and transportation—and then other essentials come next.) After that, you prioritize everything else in the budget based on your income, your situation and your Baby Step. As things change in your life, you change up where your money's going!

The 5% rule says as an investor, you should not invest more than 5% of your total portfolio in any one option alone. This simple technique will ensure you have a balanced portfolio.

The rule requires that you divide after-tax income into two categories: savings and everything else. So long as 20% of your income is used to pay yourself first, you're free to spend the remaining 80% on needs and wants. That's it. No expense categories.

The 70-20-10 budget formula divides your after-tax income into three buckets: 70% for living expenses, 20% for savings and debt, and 10% for additional savings and donations. By allocating your available income into these three distinct categories, you can better manage your money on a daily basis.

Key Takeaways

With the 80/20 rule of thumb for budgeting, you put 20% of your take-home pay into savings. The remaining 80% is for spending.

While the 50/30/20 rule is flexible in the sense that you can adjust the percentages to fit your individual financial situation, it can be inflexible in the sense that it doesn't allow for much deviation from the suggested percentages.

The 50/30/20 rule is a budgeting strategy that divides your income into three buckets: 50% for needs, 30% for wants and 20% for savings and debt payoff. What Is a Zero-Based Budget? A zero-based budget has you give every dollar you earn a job so that no money is left unaccounted for.

Are you approaching 30? How much money do you have saved? According to CNN Money, someone between the ages of 25 and 30, who makes around $40,000 a year, should have at least $4,000 saved.

Introducing the 70-20-10 rule, a realistic money budgeting rule that can make it easier to save during the cost of living crisis. Read now, save better. Introducing the 70-20-10 rule, an alternative to the old (and maybe outdated) 50-30-20 budgeting rule.

How much of your monthly income should go to groceries?

For a family of four (including two children under age 11) in 2023, your spending on groceries should be around $975 a month. You can also look at your recommended grocery spending based on a percentage of your income. Try and aim to spend no more than 15% of your take home pay on food and groceries.

Poorman suggests the popular 50/30/20 rule of thumb for paycheck allocation: 50% of net pay for essentials: groceries, bills, rent or mortgage, debt payments, and insurance. 30% for spending on dining or ordering out and entertainment. 20% for personal saving and investment goals.

The rule of thumb is that to you'll need about 80 percent of your pre-retirement income to maintain your lifestyle in retirement, although that rule requires a pretty flexible thumb.

How much do you need? Everybody has a different opinion. Most financial experts suggest you need a cash stash equal to six months of expenses: If you need $5,000 to survive every month, save $30,000.

Saving with the 50/30/20 rule and other methods

With this method, you'll set aside 50% of your monthly income to cover essential expenses (your needs), 30% for nonessential expenses (your wants) and 20% for savings.