What is the average interest rate for the US debt?

As of January 2024, the United States government has a monthly interest rate of 3.15 percent on its debt, continuing an upward trend in interest rates that began at the beginning of 2022. In March of 2023, U.S. debt reached 31.46 trillion U.S. dollars.

| FIGURE | AMOUNT |

|---|---|

| Average household debt, 2023 | $104,215 |

| Total credit card debt, Q4 2023 | $1.129 trillion |

| Average credit card debt, Q3 2023 | $6,088 |

| Total mortgage debt, Q4 2023 | $12.252 trillion |

Nearly $2 billion is spent every day just in interest on the national debt, according to the Peter G. Peterson Foundation. And when the government owes a lot, it makes it harder for corporations to borrow money.

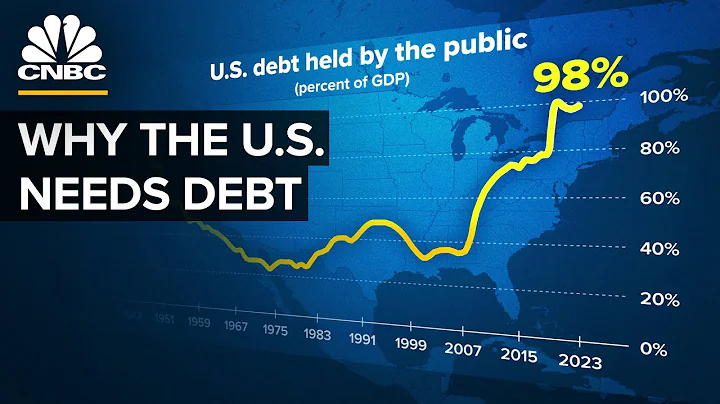

Basic Info. US Public Debt Per Capita is at a current level of 98.83K, up from 96.49K last month and up from 92.62K one year ago. This is a change of 2.42% from last month and 6.70% from one year ago.

The federal government has a 6.75 to 1 debt to revenue ratio as of Q2 2023. Historically, the U.S. public debt as a share of gross domestic product (GDP) increases during wars and recessions and then subsequently declines.

A loan's interest rate is the cost you pay to the lender for borrowing money. The Annual Percentage Rate (APR) is a measure of the interest rate plus the additional fees charged with the loan. Both are expressed as a percentage.

Real-World Example of the DTI Ratio

35% or less is generally viewed as favorable, and your debt is manageable. You likely have money remaining after paying monthly bills. 36% to 49% means your DTI ratio is adequate, but you have room for improvement. Lenders might ask for other eligibility requirements.

Gaining interest

The U.S. is on track to spend $870 billion on interest payments this year, more than the $822 billion the nation will spend on defense, thanks to ballooning debt and higher interest rates. All numbers are in billions.

The average American, based on averages from all states, will pay an estimated $130,461 over their lifetime in interest fees. This is based on mortgages, student loans, auto loans, and credit card debts in each state.

Debt held by the public, which excludes any debt owed to other U.S. government agencies, is money the U.S. Treasury has borrowed from outside lenders through financial markets. The interest on this debt is paid to individuals, businesses, pension and mutual funds, state and local governments, and foreign entities.

What country has the most debt?

Japan has the highest percentage of national debt in the world at 259.43% of its annual GDP.

At the top is Japan, whose national debt has remained above 100% of its GDP for two decades, reaching 255% in 2023.

With a population exceeding 8 million and a GDP rivaling that of many countries, New York City is a powerhouse of commerce and culture. However, it also carries a significant debt burden, with one of the highest debts per capita in the US.

- Japan. Japan held $1.1 trillion in Treasury securities as of October 2023, beating out China as the largest foreign holder of U.S. debt. ...

- China. China gets a lot of attention for holding a big chunk of the U.S. government's debt. ...

- The United Kingdom. ...

- Luxembourg. ...

- Cayman Islands.

Foreign holders of United States treasury debt

Of the total 7.6 trillion held by foreign countries, Japan and Mainland China held the greatest portions, with China holding 868.9 billion U.S. dollars in U.S. securities.

The target most commonly referenced is a 60% debt-to-GDP ratio. Despite the uncertainties surrounding the debt, there are a few things of which we can be sure: The rising debt reflects an imbalance between tax and spending policies.

| Product | Interest rate | APR |

|---|---|---|

| 30-year fixed-rate | 6.576% | 6.661% |

| 20-year fixed-rate | 6.260% | 6.359% |

| 15-year fixed-rate | 5.849% | 5.985% |

| 10-year fixed-rate | 5.750% | 5.964% |

For this example, the interest calculation is straightforward: a 6% interest rate on $30,000 results in $1,800 in interest over one year.

A 15% APR is good for credit cards and personal loans, as it's cheaper than average. On the other hand, a 15% APR is not good for mortgages, student loans, or auto loans, as it's far higher than what most borrowers should expect to pay. A 15% APR is good for a credit card. The average APR on a credit card is 22.9%.

People are paying more for food, housing and gas. Generally, it's the practical stuff that gets people into credit card debt," said Ted Rossman, credit expert at CreditCards.com. "It's all contributing to increased balances."

Which states have the worst debt?

Study shows Californians have the most debt in America, with the most average mortgage debt at $422,909. Hawaii ranks second for the most personal debt. According to data, Maryland has the most student debt, with $43,116 on average.

A debt ratio below 30% is excellent. Above 40% is critical.

What is high-interest debt? Although there is no strict definition for high-interest debt, many experts classify it as anything above the average interest rates for mortgages and student loans. These typically range between 2% and 7%, meaning that interest rates of 8% and above are considered high.

PDI is the borrowing costs of the Government, mainly incurred through issuing and servicing Government debt, and recorded as a cost to the Government in the Budget.

The interest on the national debt is how much the federal government must pay on outstanding public debt each year. The national debt includes debt owed to individuals, to businesses, and to foreign central banks, as well as intragovernmental holdings.